News Archive

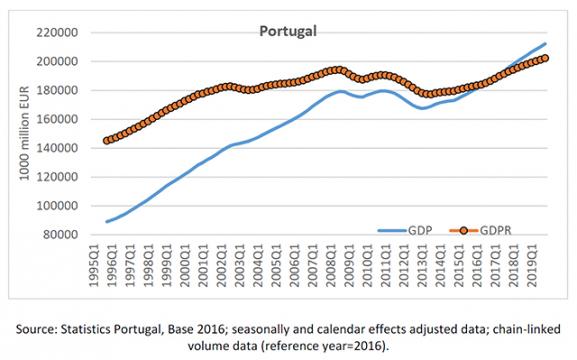

Portugal’s GDP, a Note on the 2020 Unknowns

|

EconPol Policy Brief

| News

António Afonso (EconPol Europe, Lisbon School of Economics and Management of the Universidade de Lisboa) has estimated the real growth rate of GDP in Portugal in 2020 and predicts a budget deficit of around 3% or 4% of GDP, implying a break and not a fiscal regime switch. Of particular relevance, he says, is private consumption and investment, with households cutting spending significantly and an increase in government spending necessary to cover the lack of domestic demand.

One Europe, One Future

|

EconPol Opinion

| News

In the current context of difficult times across Europe and in the World, there are relevant issues on which many people might agree, regardless of their political, ideological or theoretical views - António Afonso examines the options available and asks for compromise.

Wage Rigidities and Old-Age Unemployment

|

EconPol Policy Brief

| News

Wage smoothing is beneficial for firms and workers, but wage rigidities can lead to bilaterally inefficient separations: by comparing the impact of four policy measures regarding their impact on welfare, output and government expenditures, Martin Kerndler (TU Wien) and Michael Reiter (IHS Vienna, NYU Abu Dhabi, EconPol Europe) have identified a reasonable policy mix to counter the negative employment effects of wage rigidities.

How Corporate Debt Burdens Threaten the Economic Recovery After COVID-19 and Why Planning for Debt Restructuring Should Start Now

|

EconPol Opinion

| News

EconPol Europe's Ulrich Hege (Toulouse School of Economics, ECGI) and co-authors Bo Becker (Stockholm School of Economics, CEPR & ECGI) and Pierre Mella-Barral (Toulouse Business School) discuss the economic risks of COVID-19 and the increasingly plausible steep protraction, examine the mitigating support programs governments are putting into place for households and firms, and explain why planning for debt structuring should start now.

The Economic Costs of the Coronavirus Shutdown for Germany: A Scenario Calculation

|

Policy Brief

| News

This EconPol policy brief, using figures from the ifo Institute, calculates potential costs of coronavirus to the German economy of up to 729 billion, with up to 1.8 million jobs cut and six million workers affected by lower hours - however it stresses that the aim of any action must be to shorten the partial shutdown of the economy without compromising the fight against the epidemic, with strategies that combine a resumption of production with further containment of the epidemic.