News Archive

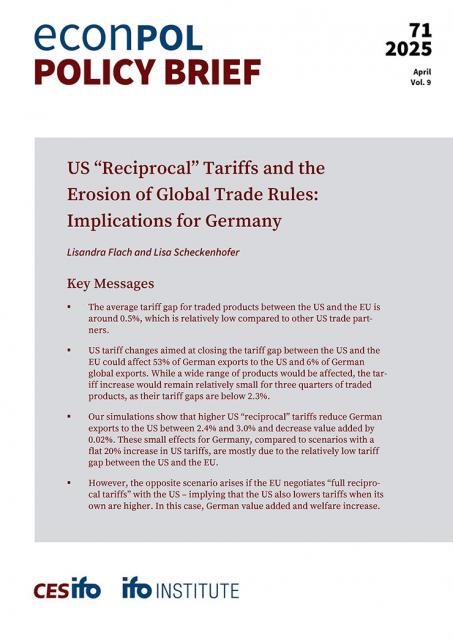

The Impact of Reciprocal US Tariffs on German Exports

|

Policy Brief

| News

If implemented on April 2, the “Liberation Day” announced by US President Donald Trump would have profound implications for the global trading system. A new Policy Brief shows that new reciprocal US tariffs would reduce German exports to the United States by 2.4% to 3%. These relatively small effects for Germany compared to a scenario with an across-the-board 20% increase in US tariffs on all trading partners are mainly due to the relatively small tariff gap between the US and the EU.

The Impact of Trump Tariffs on Mexico and Canada

|

Policy Brief

| News

US President Donald Trump’s 25% tariffs on imports from Canada and Mexico would trigger a decline of 28% in Canadian exports, 35% in Mexican and 22% in US exports, if retaliatory tariffs are imposed. Mexico’s and Canada’s manufacturing sectors would suffer the most, with value-added losses of 13% and 14%, respectively. In the U.S., the agricultural sector would take the biggest hit, facing a 2.4% drop in value added.

EconPol Newsletter: Dependencies in a Globalized World

|

Newsletter

| News

In our first newsletter of 2025 we explore the impact of global dependencies - from critical supply chains and European climate policies to Mexico’s labor market. Additionally, we share impressions from our roundtable at the Munich Conference and details on our upcoming Annual EconPol Conference in Brussels, which will center on climate adaptation.

Save the Date: EconPol Annual Conference on Climate Adaptation

|

EconPol Europe Annual Conference 2025

| News

Even under the most optimistic scenarios, climate change is expected to persist. Join us on May 19 at our Annual EconPol Conference as we explore effective adaptation strategies in response to climate change. Our high-level panel discussions will focus on policy and innovative approaches across the EU and the Global South, while also addressing the role of migration as a potential adaptation strategy.

Roundtable Discussion at the Munich Security Conference 2025

|

Event

| News

Geopolitical tensions and trade conflicts constitute an ever-growing threat to Europe’s ability to defend itself. Procuring or developing critical technologies independently or with reliable partners is crucial. EconPol Europe and the ifo institute hosted a roundtable at the Munich Security Conference to discuss ways to achieve greater technological sovereignty.