Geoeconomics

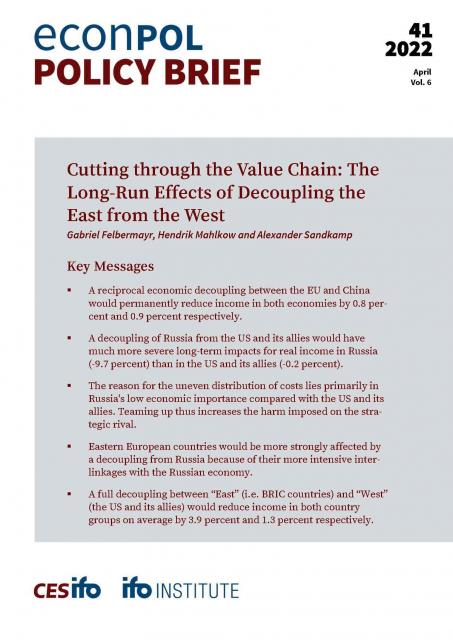

Under this moniker we have grouped the issues associated with the at times uneasy interplay between national economic interests and wider geopolitical considerations. The EU’s unhealthy dependence on Russian energy is a case in point, as well as the highly controversial Nord Stream 2 pipeline, which took a war to get cancelled. By examining economic tools and resources, such as trade, investment, sanctions, and technological developments, Geoeconomics sheds light on how states leverage their economic strength to shape global dynamics and achieve geopolitical objectives—and how this can clash with the common EU interests.